- Login

-

Paddle Billing

Paddle Billing -

ProfitWell Metrics

ProfitWell Metrics

-

Revenue and income are two metrics that are often mixed up. Knowing the difference is crucial for understanding the strength of your business strategy and true health of your business.

It's tempting to think that the relationship between revenue and income is a pretty simple one— that as long as you're keeping one of them healthy, the other will be healthy too. Not quite.

In business, revenue constitutes a business’ top line (total income through goods/services), while income is its bottom line (revenue minus the costs of doing business).

The two terms tell different but equally valuable stories. A blooming total revenue attests to an ultra-efficient sales department excellent at finding and winning new business. Your income, on the other hand, tells you how well you’re able to mesh your ability to sell into a sustainable approach to running your company.

Understanding the difference between revenue and income, and the picture they paint together about a company's financial health, is extremely important for any business, particularly in terms of how total earnings are reported in accounting.

The key differences between income and revenue mean that the two cannot be substituted for one another when reporting on a business’s financials. Let’s quickly dive deeper into these two terms before we get started.

Revenue is the total amount of money generated by the sale of goods or services, or any other use of capital or assets, associated with the main operations of a company, and before any costs or expenses are deducted. Revenue is sometimes referred to as “gross sales” or “top line.” For some businesses, this can include investment gains. As net revenue does not factor in expenses, this value sits at the top of the income statement.

Income represents the total amount of money remaining after all operating expenses, taxes, interest, and stock dividends have been deducted from an organization’s total (gross) revenue. Income is also referred to as “net income,” “net profit” or referred to as a company’s “bottom line” as it provides a full picture of cash flow in and out of a business. You may also read how to compute for net profit formula. As income accounts for expenses, this value sits at the bottom of your income statement.

Walmart’s profit for the year actually corresponds roughly to their historical revenue vs. income relationship (the year before the company's income was $9.86 billion from $500 billion revenue). Nevertheless, their gap of revenue to income illustrates that, even for huge companies, the two concepts are not easily interchangeable.

Understanding the relationship between your company's revenue and income allows you to gauge progress, build up tools for analyzing where your processes can be improved, and develop a true picture of the health of your operations.

Knowing how to track revenue and income separately is key to producing an accurate financial statement.

For the top line, ensure that all revenue streams have been accounted for, including any direct investment into the company since the release of your last statement.

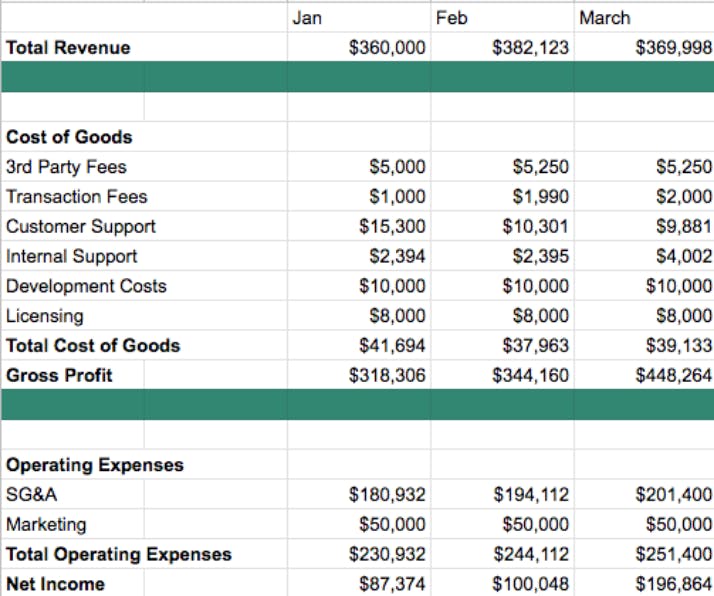

For gross income, ensure your accounting team has a grasp of the different areas of expense. A detailed loss statement can spell out selling, general and administrative (SG&A) costs often form the bulk of the expense for SaaS companies. Cost of goods and vendor fees are likely to play a part too.

It all contributes to the bottom line. If your revenue vs. income relationship is looking particularly unhealthy, you may need to consider expanding your statement reporting to include a line-by-line review of all SG&A expenses to look for ways in which those expenses can be reduced. Making reductions on seemingly marginal expenses (i.e., the expensive, brand-new 20-person office your six-person team just moved into) may not seem like difference makers, but cumulative cutbacks can improve your company’s outlook.

An accurate understanding of the revenue vs. income dynamic makes representative financial reporting possible. This is fundamental to your ability to analyze processes in your company that could be harming your bottom line.

You cannot possibly make representative month-on-month forecasts of your business without a sound grasp of how revenue breaks down to income on your balance sheet. When doing your own internal reporting, accurate numbers allow you to build estimations of next month’s revenue/income based on the relationship as it stands now and how the relationship will be affected by external factors (increase in demand, improved vendor relationships leading to lower supply costs, future increase in costs of providing service, etc.).

Beyond month-on-month forecasting, a revenue-oriented approach to a company's financial reporting won’t tell you much about your company’s long-term outlook. Basing reporting on net income, incorporating an understanding of the cost of goods sold (COGS), etc., will show you how to adapt your approach to remain competitive in the market and how to use your revenue to drive real growth.

This is what the financial reporting for a SaaS company in good health might look like. Their SG&A is under control (no need to break it out into individual expenses), vendor fees are constant, and the company has a good chance of seeing more improvement in its next month.

玻璃钢生产厂家丰泽商场美陈制作管庄商场美陈公司报价福建周年庆典商场美陈制作拉萨玻璃钢卡通雕塑阜康玻璃钢卡通座椅雕塑太原特色玻璃钢雕塑优势玻璃钢仿铜雕塑施工方法佛山发光玻璃钢雕塑太原大型玻璃钢雕塑武威城市玻璃钢雕塑周口不锈钢水景玻璃钢人物雕塑玻璃钢雕塑马用英文怎么说阳江玻璃钢雕塑设计玻璃钢动物雕塑效果图暗白色仿砂岩玻璃钢花盆玻璃钢雕塑暴力熊武汉公园玻璃钢彩绘雕塑公司河北景区玻璃钢雕塑多少钱石龙玻璃钢雕塑金华人物玻璃钢雕塑价位河南园林玻璃钢雕塑承诺守信促销玻璃钢品牌ip雕塑长沙商场美陈玻璃钢骆驼雕塑哪家不错内蒙古玻璃钢小品雕塑锦州动物玻璃钢雕塑厂家衡水长方形玻璃钢花盆太原园林玻璃钢雕塑保定仿铜玻璃钢雕塑公司贵州欧式玻璃钢雕塑图片香港通过《维护国家安全条例》两大学生合买彩票中奖一人不认账让美丽中国“从细节出发”19岁小伙救下5人后溺亡 多方发声单亲妈妈陷入热恋 14岁儿子报警汪小菲曝离婚始末遭遇山火的松茸之乡雅江山火三名扑火人员牺牲系谣言何赛飞追着代拍打萧美琴窜访捷克 外交部回应卫健委通报少年有偿捐血浆16次猝死手机成瘾是影响睡眠质量重要因素高校汽车撞人致3死16伤 司机系学生315晚会后胖东来又人满为患了小米汽车超级工厂正式揭幕中国拥有亿元资产的家庭达13.3万户周杰伦一审败诉网易男孩8年未见母亲被告知被遗忘许家印被限制高消费饲养员用铁锨驱打大熊猫被辞退男子被猫抓伤后确诊“猫抓病”特朗普无法缴纳4.54亿美元罚金倪萍分享减重40斤方法联合利华开始重组张家界的山上“长”满了韩国人?张立群任西安交通大学校长杨倩无缘巴黎奥运“重生之我在北大当嫡校长”黑马情侣提车了专访95后高颜值猪保姆考生莫言也上北大硕士复试名单了网友洛杉矶偶遇贾玲专家建议不必谈骨泥色变沉迷短剧的人就像掉进了杀猪盘奥巴马现身唐宁街 黑色着装引猜测七年后宇文玥被薅头发捞上岸事业单位女子向同事水杯投不明物质凯特王妃现身!外出购物视频曝光河南驻马店通报西平中学跳楼事件王树国卸任西安交大校长 师生送别恒大被罚41.75亿到底怎么缴男子被流浪猫绊倒 投喂者赔24万房客欠租失踪 房东直发愁西双版纳热带植物园回应蜉蝣大爆发钱人豪晒法院裁定实锤抄袭外国人感慨凌晨的中国很安全胖东来员工每周单休无小长假白宫:哈马斯三号人物被杀测试车高速逃费 小米:已补缴老人退休金被冒领16年 金额超20万