Finance

What is SaaS Gross Margin?

In the past few years, SaaS businesses saw significant value multiplication, which was great for self-belief. But just as we thought that we had bested a pandemic, rising inflation threw a wrench in many businesses’ growth plans. This meant more investor caution, longer sales cycles, and declining customer budgets.

While many businesses still chose to focus on acquisitions (and by extension, expanding revenue), many more have realized that poor processes, greater CAC, and churn bit into a larger share of that revenue.

The money inflow wasn’t enough for the counterbalance of leaked money, and hence profits and valuations dropped significantly — over $1 trillion has been wiped from the SaaS market since November of 2021.

This is why, investors and the business community alike, are now more concerned about profitability than simple revenue growth as a true north star to any businesses’ health.

This is where SaaS gross margin comes in — the revenue your company has left over (profits) after subtracting your direct costs for delivering services.

In this article, we’ll explain what SaaS gross margin is and why it’s an important metric to monitor. We’ll also look at how you can calculate it and provide actionable tips to improve it.

What Is SaaS Gross Margin?

SaaS gross margin is the revenue you have after subtracting your cost of goods sold (COGS), which is the cost incurred in delivering and maintaining your software-based product. It’s typically expressed as a percentage of your total revenue and serves as a good indicator of your company’s growth potential.

Here’s the formula to calculate your SaaS gross margin:

We’ll look at how you can calculate gross margin for SaaS businesses later on, but let’s look at why this metric is worth tracking

Why Is Gross Margin Important?

Gross margin is important because it helps you monitor and evaluate your company’s financial health. It also helps you determine how much you have left over to cover other financial obligations, such as wages, income taxes, and debt repayments.

1. It Serves As a Good Indicator of Profitability

SaaS gross profit margin allows you to compare how much gross profit you earned relative to your revenue. It allows you to determine the percentage of profits you retain after you factor in production and delivery costs for your SaaS product.

A high and positive gross margin means you’re generating more revenue than you’re spending. According to Software Equity Group, a good gross margin for a SaaS company is 75%+.

Tracking this metric over time can help you determine if you’re on the right track toward profitability. It can also help with creating revenue forecasts.

2. It Serves As a Good Indicator of Scalability

Scalability in SaaS applications is critical to support growth. However, not prioritizing your gross margin can make it difficult for any SaaS company to scale.

A high SaaS gross margin means that you’ll have more cash in hand to reinvest in business growth after accounting for direct costs. It can help you determine which areas you should focus on growing. For example, if a SaaS product has a high gross margin, you can reinvest profits into scaling its infrastructure.

3. It Helps Investors Determine Your Company’s Valuation

Building a SaaS product isn’t cheap. There are upfront technology costs, like cloud hosting services and infrastructure spending, as well as people costs, like wages and benefits. You may seek additional funding to help pay for these costs.

Comparing your gross margin to industry benchmarks can help them valuate your company and determine how much funding to approve. Companies with higher gross margins have higher median enterprise value to trailing twelve months (EV/TTM) revenue — a metric that buyers use to measure performance.

In economically stressful times, investors want to put their investments in companies with strong profitability. Of course, investors aren’t solely looking at gross profit margins. They also consider the “Rule of 40” — a principle that states that a company’s combined revenue growth rate and profit margin should exceed 40% or higher.

To summarize, SaaS gross margin is a key metric that helps you monitor your company’s financial health and measure its growth potential.

Let’s look at how you can calculate SaaS gross margin in the next section.

How Should SaaS Businesses Calculate Gross Margin?

To recap, the SaaS gross margin formula is as follows:

Gross margin = [ (Revenue - Cost of goods sold) / Revenue ] x 100

Let’s break this down.

Revenue is the total amount of income that your SaaS company receives. It typically includes the following:

Recurring subscriptions

Add-ons and extras

Premium support

Custom development work

Integration services

COGS refers to the direct costs associated with delivering software-based services. Calculating this figure for a SaaS company is trickier than for a product-based company — with a SaaS company, you don’t have “production” costs, like raw materials or factory overhead.

Of course, your SaaS company still has essential costs that are directly linked to delivering and maintaining your software-based product.

COGS for a SaaS may include:

Application hosting costs

Website maintenance fees

Software licenses for third-party apps

Employee costs for customer success

Employee costs to keep the production environment running (DevOps)

Subscription costs to run your product

Customer onboarding costs

A simple test to determine whether to include certain costs in your COGS is to ask, “Can my customers still access and use the application if I don’t pay that expense?” If the answer is no, then the expense goes into your SaaS gross margin calculation. If the answer is yes, then you exclude it

Here are some examples of what you should exclude from your COGS:

Product development costs

Sales commissions

Overhead charges

Capital expenditures

Advertising fees

Utility costs

Legal fees

If a cost isn’t directly related to your SaaS product, you wouldn’t include it in your COGS. Instead, you would place those costs under operational expenses.

Let’s bring this all together to look at how you can calculate your SaaS gross margin. Here’s the formula again for reference:

Gross margin = [ (Revenue - Cost of goods sold) / Revenue ] x 100

For this example (and for the sake of simplicity), we’ll use the Generally Accepted Accounting Principle (GAAP). This principle states that revenue is recognized only when a customer pays for a service you fulfill. If a customer signs a $15,000 annual contract and agrees to pay $1,250 a month, the full $15,000 isn’t realized. Only $1,250 a month is recognized every month.

Let’s say that your monthly GAAP revenue is $500,000. After digging into your numbers, your COGS is $150,000. Let’s plug those numbers into the SaaS gross margin formula:

($500,000 - $150,000 / $500,000) * 100

That gives you a gross margin of 70%, which means you’re earning $0.70 for each dollar of revenue you generate.

Of course, this example only shows your overall gross margin. You can (and should) calculate gross margins for different revenue streams and professional services to assess their profitability. For example, let’s say that you offer custom development work. You have a small team that provides this service, and you pay for their development tools.

If offering custom development work generates $80,000 in revenue and its COGS is $50,000, its gross margin would be 37.5% (($30,000 / $80,000) * 100). While it brings in some profits, the amount you spend could be better spent elsewhere, like scaling your technology infrastructure.

Keep the following in mind as you calculate your SaaS gross margin:

Gross margin doesn’t include operating costs or general expenses (it won’t show your bottom-line profitability)

Any major swings in gross margin should be investigated thoroughly to identify the cause (increased competition, regulatory changes, etc.)

Various factors can cause your gross margin to fall (e.g., software vendors may increase their prices)

So, what’s a “good” SaaS gross margin? Let’s find out in the next section.

What’s a Good Gross Margin for SaaS Companies?

Gross margin varies between industries.

Product-based companies tend to have lower gross margins due to their high overhead costs. For example, average gross margins are 14.25% for auto parts, 22.73% for construction supplies, and 28.40% for general electronics.

But it’s a different story for the SaaS industry, as you don’t have raw materials or freight costs to pay. As a result, having a lower COGS means a higher gross margin.

KeyBanc Capital Markets Technology Group conducted a survey of 350 private SaaS companies. These companies had an average gross margin of 73%, which included customer support in COGS but excluded companies with less than $5 million in GAAP revenue.

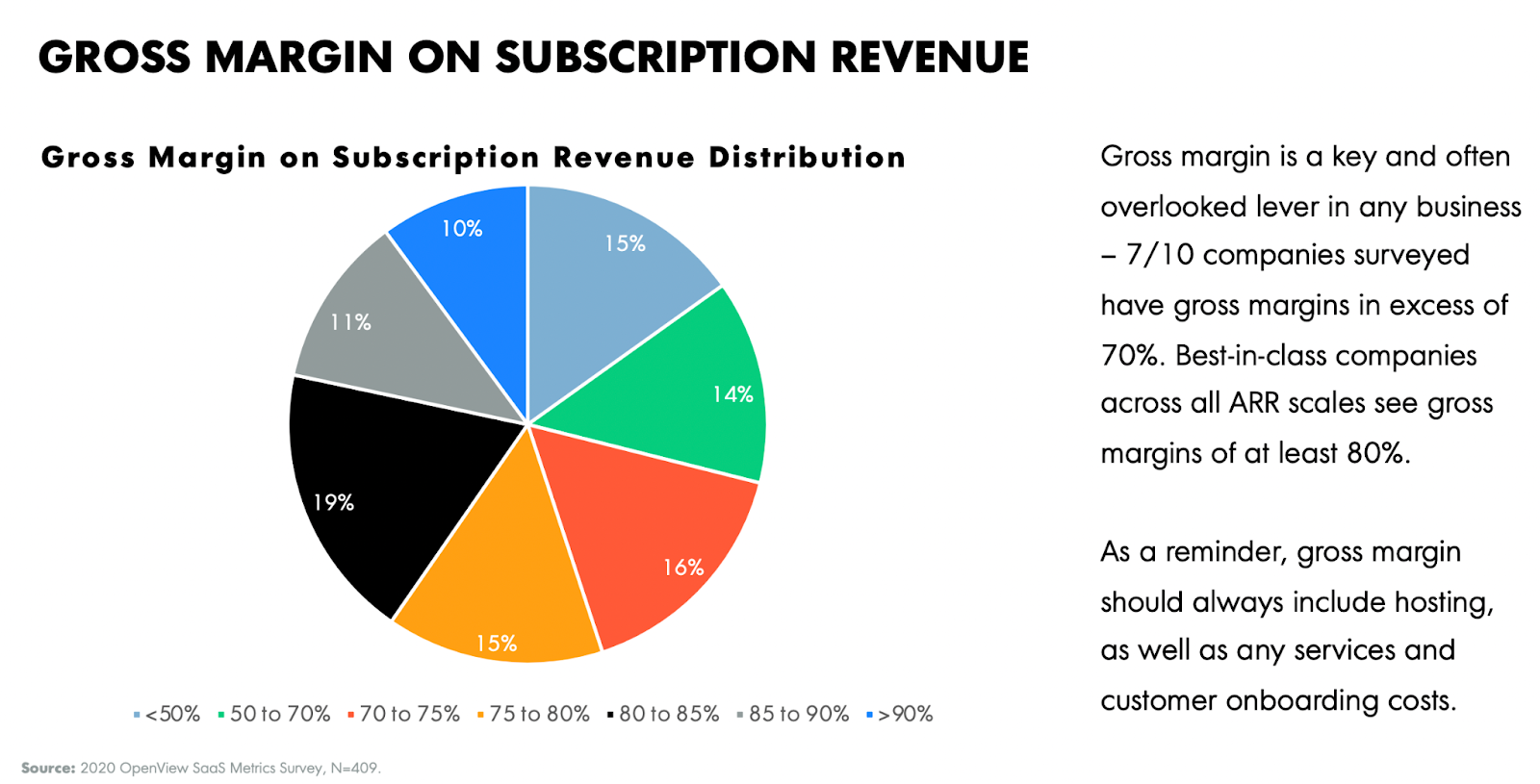

In a separate survey conducted by OpenView of more than 1,200 respondents, 7 out of 10 SaaS companies had gross margins over 70%. Best-in-class companies had gross margins of at least 80%.

Here’s a chart that shows a breakdown of gross margins on subscription revenue:

A good SaaS gross margin is anywhere from 70% to 85%. However, one thing to keep in mind is that gross margins are typically lower in a company’s early stages than in its later stages.

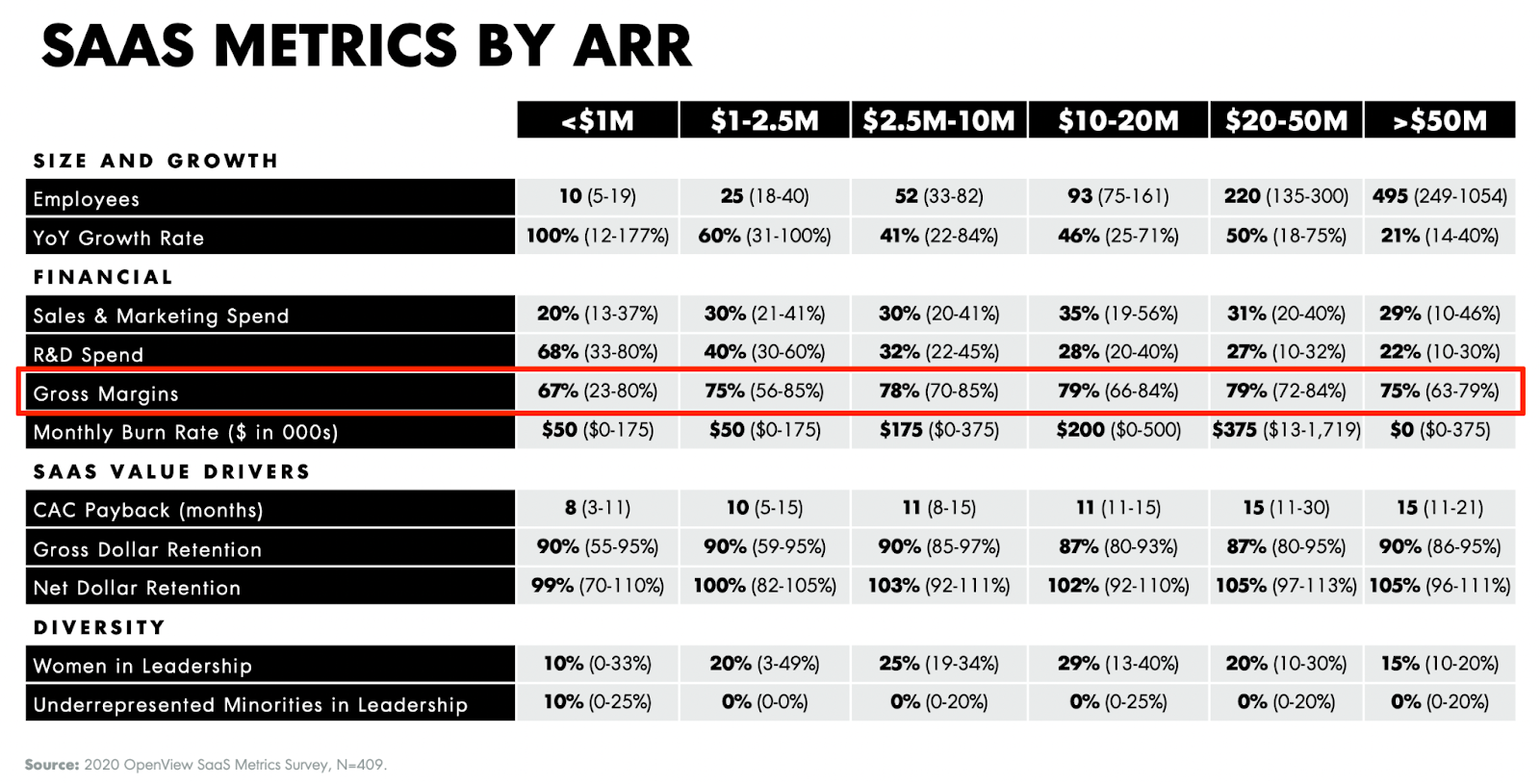

The following chart shows different SaaS metrics by Annual Recurring Revenue ( ARR), including gross margins (highlighted in red).

Smaller software companies with less than $1 million in revenue have a gross margin of 67%. Meanwhile, larger companies have a gross margin of 75% or more — they’ve learned how to operate efficiently, and they have a more solid customer base.

Of course, no matter your SaaS company’s gross margin, there’s always room for improvement.

How to Improve Gross Margin for Your SaaS Company

If your gross margin falls below the Saas gross margin benchmarks outlined in the previous section, the good news is that you can take steps to improve it.

Follow these strategies to improve your SaaS gross margin.

1. Reduce Your Cost of Goods Sold

One way to reduce your COGS is to re-evaluate the software that you use. For example, let’s say your customer success team uses one tool to onboard new users and another to manage support tickets. Switching to a platform that includes onboarding and help desk functionality can help reduce your COGS. You can also try negotiating other costs, like software licenses.

2. Evaluate Your Pricing Strategy

Setting a pricing strategy isn’t easy. Price too low, and you risk killing your profit margins, but price too high, and you’ll have a hard time attracting new customers. At the same time, you can’t afford to not experiment with your pricing because you’d only be leaving money on the table.

If it’s been a while since you’ve evaluated your pricing, there’s no better time than now. Check out our definitive pricing strategy guide to learn about different pricing strategies and how to choose the right one for your business.

3. Offer a Free Trial

Offering a free trial for your SaaS product has its risks — for instance, it can increase your overhead costs and lead to longer sales cycles. But it also gives users the opportunity to try your product. Plus, it lets you gather valuable data, like usage patterns, which you can use to improve your onboarding process. Offer a free trial if you don’t already, and track metrics like conversion rates to measure their impact on your gross margin.

4. Get Rid of Under-Performing Services

Offering different services is a great way to create new revenue streams. But these services may not generate the results you expected. Calculating gross margins for the services you offer can help you determine which ones are worth keeping and which ones aren’t.

5. Reduce Customer Churn

Customer churn is the percentage of customers that your company loses over a given period (a month or a year, for instance). While some degree of churn is inevitable, a high churn rate will negatively affect your gross margin.

Ways to reduce customer churn include improving your onboarding process, providing excellent customer support, implementing dunning workflows, and developing new features.

6. Upsell or Cross-Sell Existing Customers

Upselling is the practice of encouraging visitors to purchase higher-end products, while cross-selling is getting existing customers to buy more products, like add-ons. Offer premium plans, and get your sales team to identify customers who would benefit from extras, like new add-ons or support packages. Both strategies can improve your gross margin.

7. Expand Into New Markets

Generating more revenue is the key to increasing profitability. One way to do it is to make your SaaS product available in more markets. Of course, this isn’t easy unless you have the right payment infrastructure in place. Learn how Chargebee helped New York-based Slidebean accept recurring payments from customers in more than 30 international markets.

Improve your gross margins with Chargebee

Gross margin gives you a clearer picture of your SaaS company’s financial health. A high gross margin indicates that you’re bringing in more profits for each dollar of revenue, which means you have more money to reinvest in your business.

Of course, if you want to improve your gross margins, you’ll need a tool that helps you streamline your billing operations and discover new revenue opportunities.

Chargebee is a subscription management platform that handles the entire customer subscription lifecycle — from simplifying recurring billing workflows to automating pricing experiments to creating self-serve portals.

Schedule a demo today to see how a subscription billing and management tool like Chargebee can help scale your business and boost your growth margins.